2022 Notice of Annual Meetingand Proxy Statement

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

The Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

LIMONEIRA COMPANY

(Name of Registrant as Specified Inin Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table |

2022 Notice of Annual Meetingand Proxy Statement

Dear Fellow Stockholder:

On behalf of the Board of Directors, it is my pleasure to invite you to attend via webcast the 20222024 Annual Meeting of Stockholders (“Annual(the “Annual Meeting”) of Limoneira Company, a Delaware corporation (the “Company” or “Limoneira”). The meeting will be held on March 22, 2022,26, 2024, at 10:00 a.m. Pacific Time. Due to continuing concerns regardingTime, at the coronavirus (“COVID-19”) pandemic and to protect the well-beingMuseum of our stockholders, Board of Directors, employees and other attendees, our Annual Meeting will be a virtual meeting conducted solely online via live webcast communication. This means that you will be able to participate in the Annual Meeting and vote during the Annual Meeting via live webcast by visiting https://edge.media-server.com/mmc/p/d7o7c65g. There will be no in-person Annual Meeting. To participate in the Annual Meeting, registered stockholders will need the control number included on their proxy card and all other stockholders will need to follow the instructions that accompanied their proxy materials.

From our Board of Directors, to our over 400 employees, and everyone in between, our strong company culture and effective human capital management allowed us to navigate unprecedented societal and business challenges that continue even as of this writing in early 2022. We are extremely proud of our response to the COVID-19 pandemic with solutions to protect our employees that allowed us to continue operating as an essential business.Ventura County Agriculture Museum, 926 Railroad Avenue, Santa Paula, California, 93060.

Limoneira is ancontinues in 2024 as a company dedicated to sustainable agricultural and community development, company rooted in rich history, heritage and tradition. Limoneira is, of course, not merely a name or a brand, it is comprised of real, tangible assets, land, water, dedicated employees and strong community relationships, carefully cultivated through the decades.

Over the past two years, we have reinforced our commitment to sustainability, stewardship of our land and water resources and greater management efficiencies. We seek to not only maximize value for our customersembraced and stockholders, but to enhance our legacy by employing sustainablethen implemented best practices in all aspectsgovernance and set our course towards the “asset-light” model, reducing our non-core assets.

In December, we took the next step by initiating a further introspective process to analyze our position, juxtaposed against current opportunities, with the intention of operations including stewardship of both our natural and human resources. Whilelanding on the best corporate structure to pursue them. Our lodestar in pursuitthis evaluation process is the best interests of our objectives, we adhere to the highest standards of integrity and fairness inshareholders while respecting our relationships with employees, customers, stockholders, suppliers and our community.historic values.

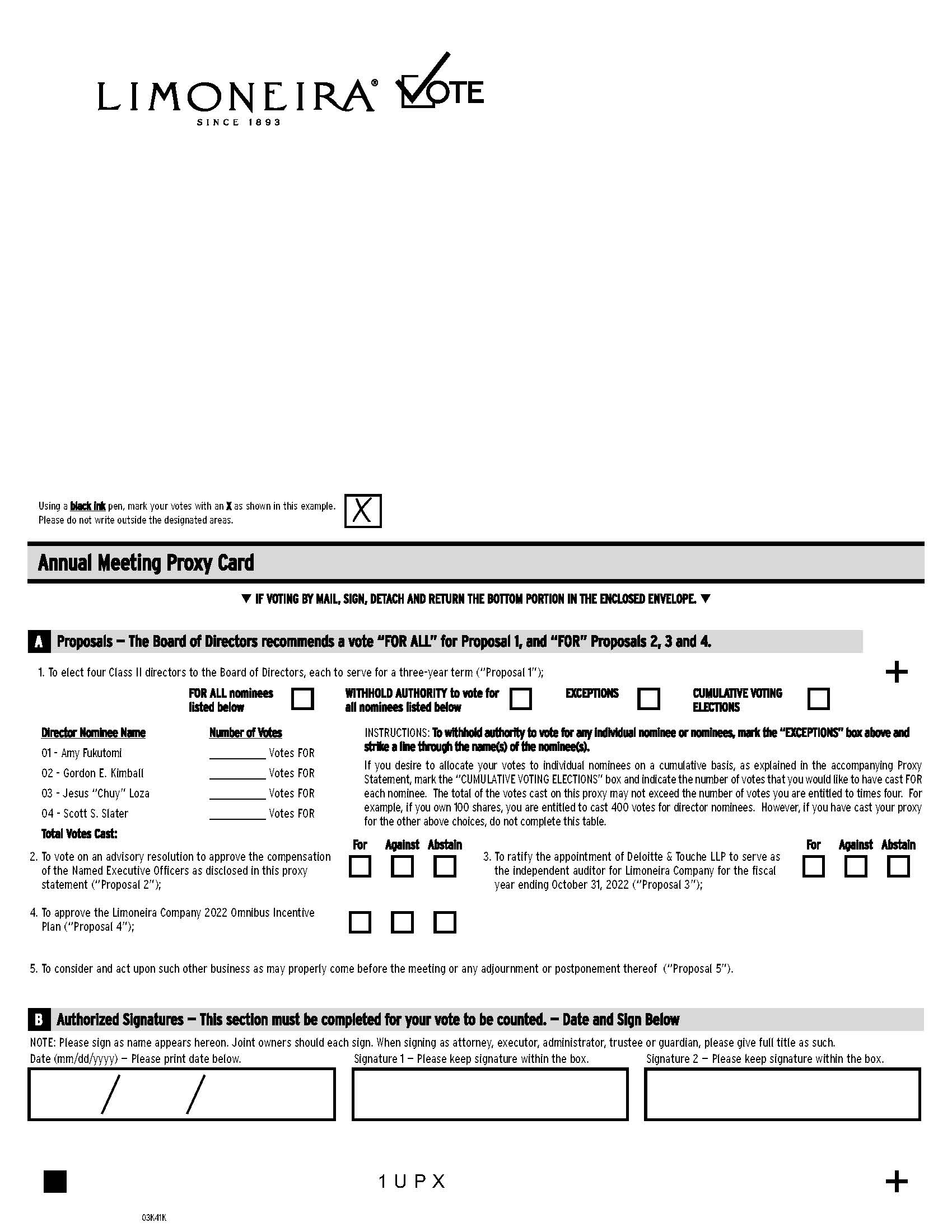

Enclosed please find our Notice of 20222024 Annual Meeting of Stockholders and Proxy Statement,proxy statement, including a proxy card and our annual report. The proxy statement contains important information about the business to be conducted at the Annual Meeting, the proposals we will consider and how you can vote your shares. Please be sure to carefully follow the instructions contained in these proxy materials.

Your vote is very important to us. We encourage you promptly to vote your shares by telephone, Internet or by completing, signing, dating and returning the enclosed proxy card, which contains instructions on how you would like your shares to be voted. Please submit your proxy card regardless of whether you will attend the virtual Annual Meeting. This will help us ensure that your vote is represented at the Annual Meeting.

On behalf of the Board of Directors and the management of Limoneira Company, I extend our appreciation for your investment in Limoneira Company.

Sincerely,

Gordon E. KimballScott S. Slater

Chairperson of the Board of Directors

Notice of Annual Meeting of StockholdersNOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held Tuesday, March 22, 202226, 2024

Limoneira Company’s 20222024 Annual Meeting of Stockholders (the “Annual Meeting”) will be held via live webcast on Tuesday, March 22, 202226, 2024, at 10:00 a.m., Pacific Time, or such later date or dates, as such Annual Meeting date may be adjourned.

The meeting can be attended via webcast by visiting https://edge.media-server.com/mmc/p/d7o7c65g. To participate inat the Annual Meeting, registered stockholders will need the control number included on their proxy card and will need to follow the instructions that accompany their proxy materials. The Annual Meeting will be heldMuseum of Ventura County Agriculture Museum, 926 Railroad Avenue, Santa Paula, California 93060, for the following purposes, as more fully described in the accompanying Proxy Statement:purposes:

•to elect fourtwo (2) Class III directors to the Board of Directors, each to serve for a three-year term (“Proposal 1”);

•to vote on an advisory resolution to approve the compensation of the Named Executive Officers as disclosed in this proxy statement (“Proposal 2”);

•to vote on an advisory resolution on the frequency of Say-on-Pay votes (“Proposal 3”);

•to ratify the appointment of Deloitte & Touche LLP to serve as the independent auditor for Limoneira Company for the fiscal year ending October 31, 20222024 (“Proposal 3”4”);

•to approve an amendment to our Restated Certificate of Incorporation to allow for the exculpation of officers (“Proposal 5”);

•to approve an amendment to the Limoneira Company 2022 Omnibus Incentive Plan to increase the number of shares of the Company’s common stock available for awards thereunder by 1,000,000 shares to 1,500,000 shares (“Proposal 4”6”); and

•to consider and act upontransact such other business as may properly come before the meeting or any adjournment or postponement thereof.

These matters are more fully described in the enclosed proxy statement. The Board of Directors recommends that you vote FOR ALL the director nominees, FOR the advisory approval of the compensation of the Named Executive Officers, for every ONE year as to the frequency of Say-on-Pay votes, FOR the ratification of the independent auditor,auditors, FOR the amendment of our Restated Certificate of Incorporation, and FOR the amendment to the Limoneira Company 2022 Omnibus Incentive Plan.

Stockholders of record at the close of business on February 1, 2022,January 31, 2024, the record date, will be entitled to notice of, and to vote at, the Annual Meeting and at any subsequent adjournments or postponements. A list of these stockholders entitled to vote at the Annual Meeting will be available for inspection for 10 days preceding the Annual Meeting at our principal executive offices at 1141 Cummings Road, Santa Paula, California 93060. We will begin mailing the Notice of Annual Meeting, proxy statement and proxy card on or about February 15, 2022,2024 to stockholders of record at the close of business on February 1, 2022.January 31, 2024.

To be sure that your shares are properly represented at the Annual Meeting,meeting, whether or not you attend, via webcast, please promptly vote your shares either by telephone, Internet or by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed envelope. We must receive your proxy card no later than 11:59 p.m. Pacific Time, on March 21, 2022.25, 2024.

You will be required to bring certain documents with you to be admitted to the Annual Meeting. Please carefully read the sections in the proxy statementmaterials on participatingattending and voting at the Annual Meeting to ensure that you comply with these requirements.

By order of the Board of Directors.

Mark PalamountainAmy FukutomiChief Financial Officer, Treasurer andVice President of Compliance & Corporate Secretary

Limoneira Company | i |

|

Table of Contents

Limoneira Company | ii |

|

Limoneira Company | iii |

|

Limoneira Company | iv | 2024 Proxy Statement |

| |

61 | |

| |

| |

62 | |

62 | |

Security Ownership of Certain Beneficial Owners and Management | 62 |

Securities Authorized for Issuance Under Equity Compensation Plans | 63 |

63 | |

63 | |

63 | |

63 | |

| |

| |

Stockholder Proposals – Inclusion in Company Proxy Statement | 64 |

64 | |

| |

| |

| |

A-1 | |

|

Except where the context indicates otherwise, “the Company,the “Company,” “we,” “us” and “our” refer to Limoneira Company and its wholly owned subsidiaries. References to “stockholders” refer to stockholders of Limoneira Company.

(This page intentionally left blank)

Limoneira Company | 1 |

|

LIMONEIRA COMPANY

1141 Cummings Road

Santa Paula, California 93060

Proxy Statement for the Annual Meeting of Stockholders

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Limoneira Company, a Delaware corporation (the “Company” or “Limoneira”), for the 20222024 Annual Meeting of Stockholders, to be held via webcast on Tuesday, March 22, 2022,26, 2024, at 10:00 a.m., Pacific Time.Time, at the Museum of Ventura County Agriculture Museum, 926 Railroad Avenue, Santa Paula, CA 93060 and for any adjournments or postponements thereof. We refer to the 20222024 Annual Meeting of Stockholders as the “Annual Meeting.” TheThis Notice of Annual Meeting, proxy statement and proxy card are first being mailed or provided to stockholders on or about February 15, 2022.2024. The costs for mailing will be paid by the Company.

ANNUAL MEETING | DateMarch 26, 2024 |

Time | |

Record Date |

As described in more detail in this proxy statement, the Annual Meeting is being held for the following purposes:

Proposal | | Board of Directors | Page Reference |

1. | to elect | FOR | Page |

2. | to vote on an advisory resolution to approve the compensation of the Named Executive Officers as disclosed in this proxy statement (“Proposal 2”); | FOR | Page |

3. | to vote on an advisory resolution on the frequency of Say-on-Pay votes (“Proposal 3”) | ONE YEAR | Page 49 |

4. | to ratify the appointment of Deloitte & Touche LLP to serve as the independent auditor for Limoneira Company for the fiscal year ending October 31, | FOR | Page |

| to approve an amendment to our Restated Certificate of Incorporation to allow for exculpation of officers (“Proposal 5”); | FOR | Page 53 |

6. | to approve an amendment to the Limoneira Company 2022 Omnibus Incentive Plan to increase the number of shares of the Company’s common stock available for awards thereunder by 1,000,000 shares to 1,500,000 shares (“Proposal | FOR | Page |

| to | ||

Limoneira Company | 2 |

|

Computershare Trust Company, N.A. (“Computershare”) has been selected asis our inspector of election. As part of its responsibilities, Computershare is required to independently verify that you are a stockholder of the Company eligible to participate in the Annual Meeting and to determine whether you may vote at the Annual Meeting. Therefore, it is very important that you follow the instructions below to participate in the Annual Meeting.

Where and when will the meeting be held?

This year’s meeting will be held on March 22, 2022,26, 2024, and will begin at 10:00 a.m., Pacific Time. The Annual Meeting will be held only by meansTime, at the Museum of a live webcast.

What if I wish to attend the meeting?

We will host the Annual Meeting live via the Internet. You will not be able to attend the Annual Meeting in person. Any stockholder can listen to and participate in the Annual Meeting live via the Internet at https://edge.media-server.com/mmc/p/d7o7c65g. The webcast will start at 10:00 a.m., Pacific Time, on March 22, 2022. Until the voting is announced to be closed, stockholders may vote while connected to the Annual Meeting on the Internet.

Instructions on how to connect and participate in the Annual Meeting, including how to demonstrate proof of ownership of our common shares, are posted at https://edge.media-server.com/mmc/p/d7o7c65g If you do not have your control number that is printed in the box marked by the arrow on your proxy card (if you received a printed copy of the proxy materials), you will need to enter as a guest and will only be able to listen to the Annual Meeting.

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will consider and vote on the following matters:

|

|

|

|

|

|

|

|

The stockholders will also consider and act on any other matters as may properly come before the meeting, or any adjournment or postponement thereof.Ventura County Agriculture Museum, 926 Railroad Avenue, Santa Paula, CA 93060.

Who is entitled to vote at the Annual Meeting?

Only stockholders of record of our common stock at the close of business on February 1, 2022January 31, 2024 (the “Record Date”), are entitled to vote at the Annual Meeting. At the close of business on the Record Date, we had 1,700,03818,004,918 shares of common stock outstanding and entitled to vote, 14,790 shares of Series B Convertible Preferred Stock outstanding and entitled to vote and 9,300 shares of Series B-2 Convertible Preferred Stock outstanding and entitled to vote, held by approximately 5,400 beneficial holders.vote. Holders of our common stock and Series B-2 Convertible Preferred Stock are entitled to one vote per share while holders of our Series B Convertible Preferred Stock are entitled to ten votes per share.

How do I participate inWhat is the purpose of the Annual Meeting?

To attendAt the Annual Meeting, log instockholders will consider and vote on the following matters:

1. Proposal 1: To elect two (2) Class I directors to the Board of Directors, each to serve for a three (3) year term. Below are the nominees for election by stockholders at https://edge.media-server.com/mmc/p/d7o7c65g. If you do not have your unique control number that is printed in the box marked by2024 Annual Meeting. Both are current directors:

Director | Age | Serving Since | Independent |

Harold S. Edwards | 58 | 2009 | No |

Edgar A. Terry | 64 | 2017 | Yes |

2. Proposal 2: To vote on an advisory resolution to approve the arrow on your proxy card (if you received a printed copycompensation of the Named Executive Officers as disclosed in this proxy materials), you will only be ablestatement.

This advisory stockholder vote is commonly known as “Say-on-Pay”. Our Board values stockholder input as we provide oversight of the strategic growth of Limoneira, and we continue to listenengage with stockholders directly. This was particularly important in fiscal year 2023 to ensure we were responsive to the “Say-on-Pay” votes at our 2022 and at our 2023 Annual Meeting.Meetings. To solicit feedback from our stockholders on our performance and strategic plan, executive compensation practices, as well as corporate governance and environmental, social and governance (“ESG”) topics, we hosted individual meetings by videoconference with several stockholders, representing approximately 30% of our outstanding common stock. Throughout the year, we participate in investor conferences and other presentations with current and prospective stockholders. Additionally, we appropriately engage our stockholders informally throughout the year as needed to provide transparency into emerging issues, to discuss milestones and to inform our decision-making. As highlighted in more detail in these proxy materials, we incorporated feedback from our stockholders directly into our decision-making as a Board in 2023.

3. Proposal 3: To vote on an advisory resolution on the frequency of Say-on-Pay votes. Stockholders may vote for a Say-On-Pay frequency of every one year, every other year, or every three years.

The Board believes that holding Say-on-Pay votes every year will provide the Board with valuable feedback from stockholders on the Company’s executive compensation policies and practices.

Limoneira Company | 3 |

|

4. Proposal 4: To ratify the appointment of Deloitte & Touche LLP to serve as the independent auditor for Limoneira Company for the fiscal year ending October 31, 2024.

Our Audit and Finance Committee (“Audit Committee”) appointed Deloitte & Touche LLP (“Deloitte”) to serve as our independent auditor to perform the audit of our consolidated financial statements for the fiscal year ended October 31, 2024, and we ask our stockholders to ratify this appointment.

5. Proposal 5: To approve an amendment to our Restated Certificate of Incorporation to allow for exculpation of officers.

The State of Delaware, which is Limoneira’s state of incorporation, enacted legislation that enables Delaware companies to limit the liability of certain officers in limited circumstances. The Board believes it is important to provide protection from certain liabilities and expenses that may discourage prospective or current directors from accepting or continuing membership on corporate boards and prospective or current officers from serving corporations. Accordingly, the Board determined that it is advisable and in the best interests of the Company and its stockholders to amend the current exculpation and liability provisions of our Restated Certificate of Incorporation, as amended, to extend exculpation protection to our officers in addition to our directors. We submitted this same proposal to the stockholders for consideration at the 2023 Annual Meeting but did not receive sufficient votes for approval, primarily due to a large number of broker non-votes, which have the same effect as a vote against this proposal.

6. Proposal 6: To approve an amendment to the Limoneira Company 2022 Omnibus Incentive Plan to increase the number of shares of the Company’s common stock available for awards thereunder by 1,000,000 shares to 1,500,000 shares.

At the 2022 Limoneira Company Annual Meeting, the Company’s stockholders approved the Limoneira Company 2022 Omnibus Incentive Plan (the “2022 Plan”). The 2022 Plan authorizes award grants of incentive stock options, nonqualified stock options, stock appreciation rights, restricted stock, restricted stock units, performance shares, performance units and any other type of award authorized by the 2022 Plan to the Company’s and its affiliates’ employees (including officers), directors and consultants. An increase in the number of shares available under the 2022 Plan is needed to continue our transition to more equity-focused incentives and expand participation in the 2022 Plan. Accordingly, we ask our stockholders to consider and approve an amendment and restatement of Section 4(a) of the 2022 Plan to increase the number of shares of the Company’s common stock available for awards by an additional 1,000,000 shares to a total of 1,500,000 shares. No other changes are being requested.

7. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The Board recommends a vote “FOR” Proposals 1, 2, 4, 5 and 6. The Board recommends a vote of every one year for Proposal 3.

What do I do if I wish to attend the meeting?

It is very important that you follow the Check-in Procedure below to attend the Annual Meeting. You will not be allowed access without the proper credentials.

Check-in Procedure for Attending the Annual Meeting

Stockholders of Record. The documents that you need to provide to be admitted to the Annual Meeting depend on whether you are a stockholder of record or represent a stockholder of record.

•Individuals: If you are a stockholder of record holding shares in your own name, you must bring to the Annual Meeting a form of government-issued photo identification (e.g., a driver’s license or passport). Trustees who are individuals and named as stockholders of record are in this category.

•Individuals Representing a Stockholder of Record: If you attend on behalf of a stockholder of record, whether such stockholder is an individual, corporation, trust or partnership:

•you must bring to the Annual Meeting a form of government-issued photo identification (e.g., a driver’s license or passport); AND

Limoneira Company | 4 | 2024 Proxy Statement |

•either:

•you must bring to the Annual Meeting a letter from that stockholder of record authorizing you to attend the Annual Meeting on their behalf; OR

•we must receive by 11:59 p.m., Pacific Time, on March 25, 2024, a duly executed proxy card from the stockholder of record appointing you as proxy.

Beneficial Owners. If your shares are held by a bank or broker (often referred to as “holding in street name”), you should go to the “Beneficial Owners” check-in area at the Annual Meeting. Because you hold your shares in street name, your name does not appear on the share register of the Company. The documents that you need to provide to be admitted to the Annual Meeting depend on whether you are a beneficial owner or represent a beneficial owner.

•Individuals. If you are a beneficial owner, you must bring to the Annual Meeting:

•a form of government-issued photo identification (e.g., a driver’s license or passport); AND

•either:

•a legal proxy that you obtained from your bank or broker; OR

•your most recent brokerage account statement or a recent letter from your bank or broker showing that you own shares of the Company.

•Individuals Representing a Beneficial Owner. If you attend on behalf of a beneficial owner, you must bring to the Annual Meeting:

•a letter from the beneficial owner authorizing you to represent such beneficial owner’s shares at the Annual Meeting; AND

•the identification and documentation specified above for individual beneficial owners.

If I am a stockholder of record of common stock, how do I vote?

If your shares of common stock are registered directly in your name with the Company’s transfer agent, Computershare, you are considered the stockholder of record with respect to those shares and you may cast your vote by any one of the following ways:

| By Telephone:Call |

| Over the Internet: Go to www.investorvote.com/ |

| By Mail: You may submit your vote by completing, signing and dating your proxy card and returning it in the prepaid envelope to Proxy Services, C/O Computershare Investor Services, PO Box |

| During the Meeting: |

Voting in Person at the Annual Meeting

Stockholders of Record. Stockholders of record may vote their shares in person at the Annual Meeting by ballot. Each proposal has a separate ballot. You must properly complete, sign, date and return the ballots to the inspector of election at the Annual Meeting to vote in person. To receive ballots, you must bring with you the documents described below:

•Individuals. You will receive ballots at the check-in table when you present your identification. If you received aalready voted by proxy card in the mail but chooseand do not want to vote by telephone or Internet,change your votes, you do not need to complete the ballots. If you do complete and return the ballots to us, your proxy card.will be automatically revoked.

When properly completed,•Individuals Voting on Behalf of Another Individual. If you vote on behalf of another individual who is a stockholder of record, we must receive by 11:59 p.m., Pacific Time, on March 25, 2024, a duly executed proxy card from such individual stockholder of record appointing you as his or her proxy. If we received the proxy card, you will ensurereceive ballots at the check-in table when you present your identification.

Limoneira Company | 5 | 2024 Proxy Statement |

•Individuals Voting on Behalf of a Legal Entity. If you represent a stockholder of record that youris a legal entity, you may vote that legal entity’s shares if it authorizes you to do so. The documents you must provide to receive ballots at the check-in table depend on whether you are voted asrepresenting a corporation, trust, partnership or other legal entity.

•If you direct. To ensure that your vote is represented atrepresent a corporation:

•you must bring to the Annual Meeting we strongly encouragea letter or other document from the corporation, on the corporation’s letterhead and signed by an officer of the corporation, that authorizes you to complete a proxy regardless of whether you plan to participate invote the Annual Meeting.corporation’s shares on its behalf; OR

YOU MAY VOTE BY PHONE OR INTERNET UNTIL VOTING IS ANNOUNCED TO BE CLOSED DURING THE ANNUAL MEETING. IF WE DO NOT RECEIVE YOUR PAPER PROXY CARD BY •we must receive by 11:59 P.M.p.m., PACIFIC TIME, ON MARCH 21, 2022Pacific Time, on March 25, 2024, a duly executed proxy card from the corporation appointing you as its proxy.

•If you represent a trust, partnership or other legal entity, YOUR PROXY WILL NOT BE VALID. IN THIS CASE, UNLESS YOU PARTICIPATE IN THE ANNUAL MEETING VIA WEBCAST, YOUR VOTE WILL NOT BE REPRESENTED.we must receive by 11:59 p.m., Pacific Time, on March 25, 2024, a duly executed proxy card from the legal entity appointing you as its proxy. A letter or other document will not be sufficient for you to vote on behalf of a trust, partnership or other legal entity other than a corporation.

If I am a beneficial owner of shares of common stock held in street name, how do I vote?Beneficial Owners.

If you hold your shares in street name, your bank, broker or itstheir appointed agent is forwarding these proxy materials to you. You should also have receivedBecause your name does not appear on the share register of the Company, you will not be able to vote in person at the Annual Meeting unless you request a voting instruction form or a notice containing voting instructionslegal proxy from your bank or broker. We strongly encouragebroker and bring it with you to promptly complete the voting instruction form and follow the voting instructions in the notice to ensure that your vote is counted. Your bank or broker will vote your shares as you instruct on the voter instruction card.

If your shares are held in street name, you must register in advance to participate in the virtual Annual Meeting. To register

•Individuals. As an individual, the legal proxy will have your name on it. You must present the legal proxy at check-in to participate inthe inspector of election at the Annual Meeting to receive your ballots.

•Individuals Voting on Behalf of a Beneficial Owner. Because the legal proxy will not have your name on it, to receive your ballots, you must submit proof of your proxy power (legal proxy) reflecting your Limoneira holdings along with your name and email addressbring to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Pacific Time, on March 17, 2022. Requests for registration by email may be made by forwarding the emailAnnual Meeting a letter from the organization who holds your shares,person or attaching an image of yourentity named on the legal proxy and emailing itthat authorizes you to legalproxy@computershare.com. Requests for registration by mail should be sent to Computershare, Attn: Legal Proxy, P.O. Box 505000, Louisville, KY 40233.vote its shares at the Annual Meeting.

What does it mean to vote by designated proxies?proxies?

The persons who are the designated proxies will vote as you direct in your proxy or voter instruction card.

Please note that proxies returned without voting directions, and without specifying a proxy to attend the Annual Meeting and vote on your behalf, will be voted by the proxies designated by our Board in accordance with the recommendations of our Board.

|

|

|

What if I want to change or revoke my vote?

You may revoke or change your proxy any time before the Annual Meeting by:

•Submitting your vote at a later time via the Internet or telephone prior to the Annual Meeting;11:59 p.m., Pacific Time on March 25, 2024; or

•Submitting a properly signed proxy card with a later date that is received at or prior to the Annual Meeting; or

•Providing notice in writing before the meeting to: Mark Palamountain, Chief Financial Officer Treasurer and Corporate Secretary,Treasurer, Limoneira Company, 1141 Cummings Road, Santa Paula, California 93060 or by facsimile to (805) 525-8211.

What if I submit a proxy without giving specific voting instructions?

If you properly submit a proxy without giving specific voting instructions, the individuals named as proxies on the proxy card will vote your shares:

•FORthe election of the fourtwo (2) Class III nominees for Director;

•FOR the approval, on an advisory basis, of the compensation of the Company’s Named Executive Officers;

•For a frequency of everyoneyear with regard to the frequency of Say-on-Pay votes;

•FORthe ratification of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal year ending October 31, 2022;2024;

•FORthe approvalproposal to amend our Restated Certificate of Incorporation to allow for exculpation of officers;

Limoneira Company | 6 | 2024 Proxy Statement |

•FOR the proposal to amend the Limoneira Company 2022 Omnibus Incentive Plan;Plan to increase the number of shares of the Company’s common stock available for awards thereunder by 1,000,000 shares to 1,500,000 shares; and

•in accordance with the best judgment of the individuals named as proxies on the proxy card on any other matters properly brought before the Annual Meeting.

Will my shares be voted if I do not provide my proxy?

If you are a registered stockholder and do not submit a proxy, you must attend the meeting via webcast in order to vote your shares up until voting is announced to be closed at the Annual Meeting. If you hold shares in “street name,” your shares may be voted with respect to discretionary matters even if you do not provide voting instructions to your bank or broker but will not be voted with respect to non-discretionary items, pursuant to current industry practice. In the case of non-discretionary items, shares not voted are treated as “broker non-votes.”

The proposals to elect two (2) Class I directors (Proposal 1), to vote on an advisory resolution to approve the executive compensation (Proposal 2), to vote on an advisory resolution on the frequency of Say-on-Pay votes (Proposal 3), to approve an amendment to our Restated Certificate of Incorporation to allow for exculpation of officers (Proposal 5), and to approve an amendment to the Limoneira Company 2022 Omnibus Incentive Plan to increase the number of shares of the Company’s common stock available for awards thereunder by 1,000,000 shares to 1,500,000 shares (Proposal 4)6) are considered non-discretionary items; therefore, you must provide instructions in order to have your shares voted on these matters. If your shares are held in street name and you do not instruct your broker how to vote, your broker will have discretion to vote your shares on our sole “routine” matter – Proposal 4, the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent auditor to perform the audit of our consolidated financial statements for the fiscal year ending October 31, 2024.

What constitutes a quorum, permitting the meeting to conduct its business?

The presence at the Annual Meeting, participating in-person via webcast or by proxy, of holders of a majority of the issued and outstanding shares of common stock entitled to vote as of the Record Date is considered a quorum for the transaction of business. If you attend the Annual Meeting to vote in person via webcast or submit a properly completed proxy by mail, by telephone or via the internet,Internet, your shares of common stock will be considered part of the quorum.

Shares represented by proxies that are marked “Abstain” or “Withhold” will be counted as shares present for purposes of determining the presence of a quorum. Shares of stock entitled to vote that are represented by broker non-votes will be counted as shares present for purposes of determining the presence of a quorum. A broker non-vote occurs when the broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power to vote on that proposal without specific voting instructions from the beneficial owner.

If the persons present or represented by proxies at the Annual Meeting do not constitute a quorum, we will postpone the Annual Meeting to a later date.

How many votes are needed to approve a proposal?

For the proposal to elect fourtwo (2) Class I directors (Proposal 1), each director nominee receiving a plurality of the votes cast at the Annual Meeting will be elected as a director. Stockholders of any class or series of stock shall be permitted to cumulate votes for the election of directors.

The proposal to approve, on an advisory basis, of the compensation of the Company’s named executive officers (“NEOs”) (Proposal 2), the proposal to ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firmauditor to perform the audit of our consolidated financial statements for the fiscal year 2022ended October 31, 2024 (Proposal 3)4), and the proposal to approve an amendment to the Limoneira Company 2022 Omnibus Incentive Plan to increase the number of shares of the Company’s common stock available for awards by 1,000,000 shares to 1,500,000 shares (Proposal 4)6), each require the affirmative vote of the holders of at least a majority of the outstanding shares present, in person or participating by proxy, at the Annual Meeting and entitled to vote atthereon is required to approve this proposal. Abstentions have the Annual Meetingsame effect as a vote “against” the proposal. Broker non-votes have no impact on these proposals.

Because the advisory vote on the frequency of Say-on-Pay votes (Proposal 3) asks stockholders to choose from one of multiple options, we will consider the frequency that receives the highest number of votes cast by stockholders to be approved.the frequency that has been selected by stockholders. Broker non-votes and abstentions will have no impact on this proposal.

Limoneira Company |

|

|

The proposal to approve an amendment to our Restated Certificate of Incorporation, as amended, to allow for the exculpation of officers (Proposal 5) requires the affirmative vote of the holders of at least a majority of the outstanding shares entitled to vote thereon; therefore, abstentions and broker non-votes have the effect of a vote against such proposal.

Computershare, the proxy tabulator and inspector of election appointed for the Annual Meeting, will tabulate all votes. Computershare will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

How is the solicitation being made?

We, the Company, are making this solicitation and as such, the cost of solicitation of proxies will be borne by us. Our directors, officers, and employees may make solicitation, personally or by telephone, email or fax. The Notice of Annual Meeting, the proxy statement, and the Proxy Materialsproxy card will be distributed to beneficial owners of common stock through brokers, custodians, nominees and other like parties, and we expect to reimburse such parties for their charges and expenses. We have retained Morrow Sodali, a proxy solicitor, to assist us in the solicitation of proxies for the Annual Meeting. The Company will pay Morrow Sodali $25,000 plus reimbursement for its reasonable out-of-pocket expenses. The Company will indemnify Morrow Sodali and its affiliates against certain claims, liabilities, losses, damages and expenses for its services as our proxy solicitor.

We may supplement the original solicitation of proxies by mail with solicitation by telephone, and other means by directors, officers and/or employees of the Company.Company and by Internet, phone, or other means by Morrow Sodali. We will not pay any additional compensation to these individuals, other than Morrow Sodali, for any such services.

What should I do if I have any questions?

If you have any questions or require any assistance with voting your shares of common stock, please contact via mail directed toMorrow Sodali, our corporate headquarters located at: Limoneira Company, 1141 Cummings Road, Santa Paula, California 93060, attention: Mark Palamountain, Chief Financial Officer, Treasurerproxy solicitor, by calling 800- 662-5200, or banks and Corporate Secretary,brokers can call (203) 658-9400, or by facsimileemailing LMNR@investor.morrowsodali.com.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K within four (4) business days after the Annual Meeting. If final voting results are not available to (805) 525-8211.us at that time, we intend to file a current report on Form 8-K to publish preliminary results and, within four (4) business days after the final results are known to us, file an amendment to such current report on Form 8-K to publish the final results.

Limoneira Company |

|

|

Business Performance/Performance / Fiscal Year 2023 Achievements / Recent Events

On October 10, 2022, we entered into a Purchase and Sale Agreement, as amended (the “Purchase Agreement”), with PGIM Real Estate Finance, LLC (“PGIM”) to sell 3,537 acres of land and citrus orchards in Tulare County, California (the “Northern Properties”) for an adjusted purchase price of approximately $100.0 million. The Purchase Agreement became effective on January 25, 2023, when the Board approved the Purchase Agreement, binding us to sell the Northern Properties and the transaction closed on January 31, 2023. We are equal partnersreceived net cash proceeds of approximately $98.4 million and recorded a gain of approximately $40.0 million. The proceeds were used primarily to pay down debt.

On January 31, 2023, we entered into a Farm Management Agreement (the “FMA”) with an affiliate of PGIM to provide farming, management and operations services related to the Northern Properties. The FMA has an initial term expiring March 31, 2024, and thereafter continuing from year to year unless earlier terminated under the terms of the FMA. Further, on January 31, 2023, we entered into a Grower Packing and Marketing Agreement to provide packing, marketing and selling services for lemons harvested on the Northern Properties for a minimum five-year term, subject to certain benchmarking standards.

On November 30, 2022, we sold our Sevilla property, received net proceeds of $2.6 million and recorded an immaterial loss in the first quarter of fiscal year 2023.

On April 18, 2023, we entered into a Confidential Settlement Agreement and Release (the “Settlement Agreement”) with Southern California Edison and Edison International to formally resolve any and all claims related to the Thomas Fire in fiscal year 2018. Under the terms of the Settlement Agreement, the Company was awarded a total settlement of $9.0 million. On May 19, 2023, the Company received approximately $6.1 million, net of legal and related costs.

In April 2023, we determined that citrus farming operations were economically unviable on 670 acres of leased agricultural land at the Cadiz Ranch. As a result, we ceased farming operations, disposed of the related property, plant and equipment and recorded a loss on disposal of assets of $9.0 million in the second quarter of fiscal year 2023.

In August 2023, we engaged with Yuma Mesa Irrigation and Drainage District and the United States Bureau of Reclamation in a joint venture with The Lewis Groupfallowing and forbearance program at our Associated Citrus Packers, Inc. ranch in Yuma, Arizona. We expect to receive approximately $1.3 million annually, paid in quarterly installments, for fallowing approximately 600 acres out of Companies (“Lewis”) for the residential development1,300 acres of our East Area I real estate development project. To consummate the transaction, we formedfarmland through calendar year 2025.

In October 2023, Limoneira Lewis Community Builders, LLC (“LLCB”) as the development entity. The first phase of the project broke ground to commence mass grading in November 2017. LLCB has closed on lot sales representing 586121 residential units from inception through October 31, 2021, including 232 unitsand we recorded equity in earnings of investments of $5.1 million for fiscal year 2021. For further information see Note 7 – Real Estate Development of the notes to consolidated financial statements included in our fiscal year 2022 Annual Report on Form 10-K.

In December 2020, we received $5.0 million of federal income tax refunds related to the Coronavirus Aid Relief and Economic Security Act (“CARES Act”) and received an additional $0.9 million of California state refunds in the third quarter of fiscal year 2021.

In June 2021, we entered into an agreement, effective March 1, 2021, to sell and license certain assets of Trapani Fresh to our 49% partner in the joint venture, FGF Trapani (“FGF”). These assets consist of packing supplies and certain intangible assets related to the packing, marketing, and selling business of Trapani Fresh. The total consideration to be received is approximately $3.9 million over an 8-year term in 16 equal installments. There was no material gain or loss recognized on the transaction. In August 2021, we entered into several additional agreements whereby the additional 25% interest in Finca Santa Clara (“Santa Clara”) was transferred into the trust resulting in the trust now holding a 100% interest in Santa Clara. Trapani Fresh owns and operates the 1,200-acre Santa Clara ranch and now sells the lemons it grows to FGF, who packs, markets, and sells the fruit to its customers. As a result of this transaction, Trapani Fresh now recognizes lemon revenues at the market price, less packinghouse charges to harvest, pack and market the fruit.

In June 2021, we entered into a Master Loan Agreement (the “MLA”) with Farm Credit West, PCA (the “Lender”) dated June 1, 2021, together with a revolving credit facility supplement (the “Revolving Credit Supplement”), a non-revolving credit facility supplement (the “Non-Revolving Credit Supplement,” and together with the Revolving Credit Supplement, the “Supplements”) and an agreement to convert to fixed interest rate (“Fixed Interest Rate Agreement”). The MLA governs the terms of the Supplements. The MLA amends and restates the previous Master Loan Agreement between our Company and the Lender, dated June 19, 2017 and extends the principal repayment to July 1, 2026.

In July 2021, we entered into a non-binding letter of intent to sell approximately 25 acres of our East Area II property in five staged purchases to an investment company for the purpose of constructing a medical campus consisting of medical office buildings and an acute care hospital. Completion of the transaction is subject to the execution of a purchase and sale agreement and resolution of certain contingencies.

In August 2021, we entered into an equipment finance agreement (the “FCW term loan”) with the Lender in the amount of $2.5 million and used the proceeds to pay off the Wells Fargo term loan. The FCW term loan has a fixed interest rate of 3.19% and is payable in monthly installments through September 2026.

In September 2021, the Board of Directors of our Company approved a share repurchase program authorizing us to repurchase up to $10.0 million of our outstanding shares of common stock through September 2022. No shares have been repurchased under this program as of the date of this Proxy Statement.2023.

On December 14, 2021,1, 2023, we announced the commencement of a strategic review process to explore potential alternatives aimed at maximizing stockholder value. Potential strategic alternatives could include, but not be limited to, a sale of all or parts of the Company and its assets, a merger or other transaction. The Board has not set a timetable for completion of the review and no transaction or other outcome is guaranteed to take place. At this time, we cannot predict the impact that such strategic alternatives might have on our business, operations or financial condition.

On December 19, 2023, we declared a cash dividend of $0.075 per common share, which was paid on January 14, 2022,12, 2024, in the aggregate amount of approximately $1.3 million to stockholders of record as of December 27, 2021.January 2, 2024.

On January 1, 2024, Elizabeth Blanchard Chess retired from the Board. The Board appointed Peter J. Nolan, to fill the vacancy created by the retirement of Ms. Chess, effective January 1, 2024.

The COVID-19 pandemic has had an adverse impact on the industries and markets in which we conduct our business. In particular, the United States lemon market saw a significant decline in volume, with lemon demand falling since widespread shelter in place orders were issued in March 2020, resulting in a significant market oversupply. The export market for fresh produce also significantly declined due to the COVID-19 pandemic impacts.

Limoneira Company |

|

|

The decline in demand for our products beginning the second quarter of fiscal year 2020 has negatively impacted our sales and profitability for the last four fiscal years. The COVID-19 pandemic may continue to impact our sales and profitability in future periods. The duration of these trends and the magnitude of such impacts cannot be estimated at this time, as they are influenced by a number of factors, many of which are outside management’s control, including, but not limited, to those presented in Item 1A. Risk Factors our Annual Report on Form 10-K, filed with the Securities and Exchange Commission on December 21, 2023.

Given the economic uncertainty as a result of the COVID-19 pandemic over the past four fiscal years, we have taken actions to improve our current liquidity position, including strategically selling certain assets, temporarily postponing capital expenditures and substantially reducing discretionary spending.

There is continued uncertainty around the breadth and duration of our business disruptions related to the COVID-19 pandemic, as well as its impact on the U.S. economy and the ongoing business operations of our customers. The ongoing impact of the COVID-19 pandemic on our results of operations, financial condition, or liquidity for fiscal year 2024 and beyond cannot be estimated at this point.

Limoneira Company | 10 | 2024 Proxy Statement |

“Limoneira is an agricultural and community development company which, based upon its rich heritage and traditions, seeks to not only maximize value for its customers and stockholders, but to enhance its legacy by employing sustainable practices in all aspects of operations including stewardship of both its natural and human resources.”

For 129over 130 years, Limoneira Company has contributedbeen dedicated to society in many ways by taking carefostering the wellbeing of our communities, employees, and their families,families. We are committed to being a force for good neighbor inwithin our local communities,neighborhoods, conducting business with unwavering ethics, caring for the land that supports us, and operating our business in an ethical, environmentally responsible and socially inclusive manner.promoting inclusivity. Our progresssuccess is not onlyjust measured byin dollars, but init is manifested by the tangible improvements of the lives we touch and the communities we lift. support.

Limoneira recognizesis committed to bolstering the increased emphasis by stockholders,strength, transparency, and substance of our ESG programs, through which we can minimize our environmental impact, support nature, enhance the protection of human rights, and operate with steadfast ethical responsibility. We listen to feedback from our employees, stakeholders, investors, business partners, and other key constituents in recent years on environmental, socialessential contributors to continually evolve our practices as we strive to exceed their expectations.

At the core of our beliefs lie the wellbeing of people and governance (“ESG”) sustainability programs.

We are continuingour planet, and we consistently invest to make both financialadvance the benefit of each. Our workforce forms a cohesive and human capital investments relating to sustainability stewardship. It startscollaborative team that is characterized by inclusivity, diversity, and alignment with cohesive teams that are collaborative, inclusive, and diverse, and that are aligned around our mission statement and core philosophy. More important than settingWe are resolute in our efforts to achieve the ambitious goals set for ourselves and reinforced throughout our leadership team.

The Nominating and Corporate Governance Committee (the “Nominating Committee”) of our Board oversees our ESG programs and practices, including climate change, human capital management, diversity, stakeholder relations, and health, safety and the environment. The Nominating Committee considers long- and short-term trends and their potential environmental and social impacts to our business. The Nominating Committee’s role in overseeing our ESG programs has been formally designated and codified in the Nominating Committee’s charter. The Chairperson of this committee, Elizabeth Mora, is achieving them. Leadersa seasoned ESG professional who provides guidance to our Board and management. Our ESG programs are responsiblemanaged by our Vice President of Compliance and Corporate Secretary, Amy Fukutomi, who reports directly to our CEO, Mr. Edwards.

During 2023, Limoneira was proud to introduce a formal ESG Council, which oversees policies and operational controls of environmental risks. The ESG Council is chaired by Ms. Fukutomi and is comprised of members of Senior Management, company Vice Presidents and department stakeholders. We also bolstered our Corporate Social Responsibility Committee (“CSR Committee”), which oversees human rights, supply chain and customer social audits and is chaired by our Director of Human Resources, Debra Walker.

Limoneira Company | 11 | 2024 Proxy Statement |

The ESG Council also functions as the Company’s Environmental Management System (“EMS”), which provides a formal structure for embedding these targets throughout their operationsreducing our environmental impact and are held accountableimproving operating efficiency. The roadmap of our EMS, as set forth below, outlines the procedure for continuously identifying problems, planning solutions, implementing the solutions, measuring progress, and ultimatelyreviewing results before returning to the achievementidentification phase. Our Board considers any environmental, social, or health and safety matters at each of its quarterly meetings with direct reports provided by our EMS lead, Ms. Fukutomi.

Limoneira Company | 12 | 2024 Proxy Statement |

Sustainable Development Goals Roadmap

Limoneira aligns with the United Nation’s Sustainable Development Goals (“SDGs”). While the goals were originally developed for use by governments, the goals prove to be valuable for corporations as well. We use the SDGs to inform the direction of our targets including through the annual compensation process.

If 2021 taught us anything, it is that societysustainability program and our industry will continue to face new challenges. Limoneira is committed to being a catalyst for positive change and we continue to view these challenges as an opportunity to create a better future. In short, we believe we can do well by doing good sustainable things.

The Company is committed to improved reporting around these andalign on common goals with other programs that impact ESG visibility. The Company has an executive-led cross-functional team (the “ESG Group”) that includes representation from our Board, senior management, human resources, compliance and operations. The ESG Group has been tasked with taking meaningful steps to establish a series of short-term and long-term goals that demonstrate our commitment to further improvement.like-minded institutions.

We are We are committed to improving the lives of all our stakeholders by helping to provide access to our products, We are |  |

We have a long history of strong commitment to being an ethicalGovernance

Operating ethically and responsible company acting with integrity while abiding by local, regional, and respect for each other,national regulatory and legal standards governing our communities,industry is an integral part of how we do business— and we expect the environment. The Nominatingsame from our partners and Corporate Governance Committeesupply chain. We disclose policies on our website that govern how we operate and help ensure enterprise-wide compliance to further increase the trust and support of our Boardstakeholders.

Every Company employee is tasked with the responsibility for overseeingguided by our ESG and sustainability programs and practices, including considering potential long- and short-term trends and impacts that environmental and social responsibility and sustainability issues may have related to our business.Code of Ethics (“2023 Ethics Code”). The chairperson of our Nominating and Corporate Governance Committee is a seasoned ESG professional who provides guidance2023 Ethics Code applies to our Board, as well asall of our employees and others conducting business on our behalf, including consultants, contract workers and temporary workers (as applicable by law). We require annual certification of our Ethics Code by employees and our Board. See additional details under the ESG Group. Theheading “Corporate Governance and Related Matters.”

Risk management is an essential and dynamic process involving the identification, evaluation, and response to potential threats and uncertainties that could potentially impact the business. Risks may arise from a variety of sources including regulatory changes, environmental factors, natural disasters, economic pressures, technological disruptions, health and safety, and human rights risks across the supply chain. Ultimate oversight of the Company’s risks lies with the Board and its Risk Management Committee (“Risk Committee”).

Limoneira recognizes that cybersecurity is an important aspect of risk management. Our Board and its Risk Committee oversee our cybersecurity program and receive regular reports from our management team to ensure that directors are fully versed on this topic and evaluate the program on a continual basis for its scope and efficacy. Our Vice President of Packing and Technology and Director of Compliance & Business Development, also a memberInformation Technology directly manage information security and lead the development of enterprise-wide policies, standards, strategies, architectures, and processes.

We are committed to continued investment and strengthening of our Board, leads our ESG initiatives.computer systems, software, networks, and other technological assets. Our information security program is designed to preserve the integrity, confidentiality, and continued availability of data owned by, or in the care of, the Company and to protect against cybersecurity attacks by unauthorized parties or individuals attempting to gain access to confidential information, destroy data, degrade or disrupt service, sabotage systems, or otherwise cause damage.

Limoneira Company |

|

|

With a rich history spanning over 130 years, Limoneira is committeda foundational member of the communities in which it operates. We entrench community outreach as a cornerstone of our ethos. As a key employer in the area, we recognize that our successes are mutually intwined. Through outreach events, philanthropic giving, and active participation in the surrounding communities, we strive to protecting the human rights, safety and dignity ofsupport the people who contributehave supported us throughout our long history.

Limoneira continues its relationship with the University of California – Santa Barbara’s Bren School of Environmental Science and Management (“UCSB”). For our second year, we hosted a talented intern from the school who worked closely with our sustainability team to evaluate greenhouse gas emissions and minimize our environmental impact. We also work closely with another team at UCSB whose two-year master’s degree project is to help us assess the successimpact of certain organic soil amendments within our orchards. The selection of these programs is extremely competitive, and we are honored to have our project chosen. We place a high value on education, and we look forward to continuing to build our relationship with UCSB and supporting the future of sustainable environmental knowledge.

Employee wellbeing and safety stand as non-negotiable priorities at Limoneira. We recognize that our team members are the life force of our business. We also seekorganization, and we make every effort to support the welfarepromote a culture of the people who produce, process and harvest the products we sell. Limoneira has a Social Responsibility Committee with representation from our Board, senior management, compliance, human resources and operations.

Limoneira’s overall culture emphasizes the health and safety. We firmly believe that a healthy, safe, and valued workforce not only drives our success but also embodies the core values that define Limoneira’s culture and identity. In addition to our best-in-class benefits and 401(k) matching, this year, we introduced an expanded suite of physical and mental health resources for employees. We continue to evaluate our safety practices on an ongoing basis and provide general and departmental safety training to ensure that we maintain a safe working environment for all employees.

Human rights are the foundation of our employeesa just and the customers we serve. Our Take a Healthy Stand™ campaign showcases the many ways lemons can play a role in helping to alleviate serious health issuesequitable society, and our free Nature’s Pharmacy™ app links items found in the produce section of local grocery stores to related health benefits. Our Take A Healthy Stand™ educational campaign is supported by research from the National Institute of Health and other objective organizations. Recipes, tips & tricks are developed for Limoneira by Megan Roosevelt, a registered dietitian nutritionist and founder of Healthy Grocery Girl®. Reputable outsides sources are also used for additional recipes, tips & tricks.

Further, Limoneira supports the efforts of the Produce Marketing Association and the United Fresh Produce Association (collectively, the “Association”) to create an industry-wide framework for the responsible production and procurement of fresh fruit, vegetables and flowers. This mission is captured by the Association’s Ethical Charter on Responsible Labor Practices, of which Limoneira is one of many endorsers representing the fresh produce industry that includes growers, labor agencies, packers, distributors, foodservice operators, marketers and retailers. In addition, Limoneira has adopted its own Ethical Charter on Responsible Labor Practices (the “Charter”). The Charter includes but is not limited to: prohibiting the use of forced labor and child labor; preventing harassment, abuse and violence in the work environment; ensuring a non-discriminatory work environment; ensuring a safe and healthy work environment; permitting freedom of association and collective bargaining; providing at least the minimum wage and benefits required by law in locations where we and our suppliers do business; ensuring working hours do not exceed the maximum set by applicable law; and operating in strict compliancededicated to safeguarding them with all applicable laws. The Charter can be found on our website, www.limoneira.com, under the headings “Investor — Corporate Governance — Ethics and Other Policies.”

Supplier Code of Conduct

We established a Supplier Code of Conduct (“Supplier Code”) to protect the human rights and safety of our supply chain.unwavering commitment. We recognize that every individual, regardless of race, ethnicity, nationality, gender, religion, sexual orientation, sexual identity, or disability status possesses inherent entitlement to fundamental respect and respect the cultural and legal differences found worldwide. In order to aligndignity—as aligned with international standards, our Supplier Code is derived from the policies, standards, and conventions of the United Nations including the principles relatedUniversal Declaration of Human Rights. At Limoneira, we are committed to promoting these rights and providing a discrimination-free workplace where every voice is not just heard but valued. Limoneira requires that any members of its supply chain adhere to internationally recognized human rights labor standards environmentincluding provisions on working time and anti-corruption includedsafe working environments, while prohibiting behaviors such as discrimination and forced and child labor.

•Carbon Emissions- Limoneira reduced its annual emissions by 5% from the previous year.

•Renewable Electricity- Limoneira’s energy mix increased to 55% electricity from renewables, which is improved from 44% last year. This comes from our on-site solar installations and renewable electricity purchased from the grid.

•Orchard Biodiversity- We planted an additional 197 acres of cover crop, increasing our total biodiversity acreage to 480. These acres feature a rich diversity of native vegetation that supports soil health and above and below ground biodiversity.

•Water Consumption- Our water consumption reduced from 4.2 to 3.6 acre-feet per acre. In addition to participation in the United Nations Global Compact. Limoneira also has a Policyfallow-based water conservation programs, this reduction in water consumption is made possible by high efficiency irrigation systems and water monitoring technology, combined with an emphasis on Human Rightssoil health and Labor (“Policy”). Our Policy and Supplier Code are global in scope and apply to all companies in our supply chain and their facilities, as well as our facilities and operations. The Policy can be found on our website, www.limoneira.com, under the headings “Investor — Corporate Governance — Ethics and Other Policies.”regenerative practices.

Limoneira employs a risk-based approach with respect to audits (including environmental, social and governance audits) and seeking to confirm compliance with the Supplier Code. When such audits disclose the need for improvement, Limoneira requires suppliers to adopt corrective action plans and performs subsequent audits to determine progress. Limoneira also offers other capacity building servicesrecognizes that improve management systems to address the root causes of alleged violations. Limoneira works with suppliers and/or their facilities to correct Supplier Code violations. Depending on the severity or lack of remediation of Supplier Code violations, Limoneira reserves the right to terminate our relationship and/or purchase orders with a supplier and/or their facility.

Limoneira continually educates our employees on the importance of our Policy and Supplier Code through updated training and in-person seminars to review the requirements and any changes. We also provide annual training for employees and management on the Company’s policies related to discrimination (age, race, sexual orientation, gender identity, and gender expression), ethics, corruption, safety as well as a variety of other factors.

Serving Our Communities

We have deep roots in our communities and each year we collaborate with and devote resources to many worthwhile entities that make our communities special places to live and work. Management and employees volunteer time and resources for various industry, community and non-profit organizations by serving on their boards and committees and staffing events. Our teams work together to raise awareness, generateagriculture would be impossible without natural resources, and participate in events that resonatewe created an array of initiatives to promote and protect them. Our team is constantly experimenting with regenerative practices to utilize land and water resources as efficiently as possible, while we continue to expand our local teams, customersapplication of cover crops and community members. At the local level, some of these initiatives include Santa Paulapollinator habitats to support above and belowground biodiversity.

Limoneira Company |

|

|

Much of Commerce, Boys and Girls Club of Santa Clara Valley, Ventura County Food Safety Association, COLAB – Coalition of Labor Agriculture and Business, Students for Eco Education and Agriculture, California Women for Agriculture, Canyon Irrigation Company, and California Arizona Lemon Growers Association.

As part ofthe conversation surrounding climate change revolves around greenhouse gas emissions, specifically carbon dioxide. While we avoid significant emissions through our ongoing commitment to our communities, we sponsor many charities and events. We fund children’s agricultural education, college scholarships, health and human services, industry, community, cultural events and projects that make our communities more vibrant and sustainable. Limoneira also founded a federal credit union, which is housed onsite at our corporate office, to provide agricultural employees an opportunity to accumulate savings and create a source of credit. Harvest at Limoneira, our master-planned community, continues our long history of building, integrating and sustaining community to promote economic, social and cultural vitality in our community

Employee Engagement

At October 31, 2021, we had 268 employees, of which 98 were salaried and 170 were hourly. None of our employees are subject to a collective bargaining agreement. We believe that our relations with our employees are good.

Limoneira’s overall culture emphasizes the health and safety of our employeessolar installations and the customerspurchase of renewable electricity from the grid, our sustainability and farming teams work hand-in-hand to create innovative solutions for minimizing soil-based emissions from fertilizers. We conduct a number of exciting experiments as we serve. We strive to be a great place for our employees to work and live. We offer competitive pay and best-in-class benefits, including a 401k plan with matching contribution opportunities, comprehensive paid healthcare plans, wellness programs, and tuition reimbursement.lead the way in sustainable agriculture.

Limoneira has an Illness and Injury Prevention Plan (IIPP), a Safety Guide and conforms to and follows regulations and guidelines set forth by OSHA in our facilities and operations. Where the State’s guidelines, such as Cal OHSA, are different from the OSHA standard, Limoneira adheres to the more restrictive standard. In response to the COVID-19 pandemic, we implemented, and continue to improve, appropriate safety measures in our facilities and locations.Climate Smart Agriculture

Limoneira is committeddedicated to anminimizing negative impacts on the environment, where opena goal we are accomplishing in part by leveraging the natural services provided by our ecosystem. This approach allows us to replace chemical additives with natural processes, saving time and honest communications aremoney while avoiding damage to the norm, notnatural world. One example of this is integrated pest management, wherein we deploy a variety of non-chemical controls, such as beneficial insect releases, as a primary line of defense against harmful pests.

Landfilled waste can be a significant source of emissions and environmental contamination. Through our partnership with Agromin, Limoneira composted and diverted over 4,400 tons of organic waste from the exception. We encourage our team members to feel comfortable in approaching supervisors and management. By creating open channelslandfill — comprising 88% of communication, we promote a positive work environment. An effective reporting system augments our efforts to foster a culture of integrity and ethical decision-making. We selected EthicsPoint, an independent third-party service, to provide us with an anonymous and confidential method for employees to voice their concerns and make reports of alleged misconduct.

Workforce Housing

We own and maintain over 250 residential housing units located in Ventura and Tulare Counties in California. We lease these housing units to employees, former employees and non-employees. Our residential units provide affordable housing to many of our employees, including our agribusiness employees. Employees live close to their work, which reduces traffic and commuting times. Many live onsite at our packinghouse operations and ranches in Santa Paula. This unique employment benefit helps us maintain a dependable, long-term employee base. We partner with some local schools to provide transportation for residents.

Environmental Conservation

the Company’s total waste by mass. We are dedicatedrolling out additional initiatives to practices that strengthenimprove recycling in our business while reducing negativeoffices, including electronics waste, food waste, and mixed recycling. These initiatives not only avoid emissions and environmental impact. We have a long-standing commitment to environmentally responsible operations and seek to continually improve sustainability throughout the life cycle of our products, including farming, harvest, production, operations, packaging and disposal.

Our business relies on the health of our planet and the well-being of our customerscontamination, but also conserve natural resources for its continued success. Given the importance of the land to our business, sustainability has always been integrated into our business strategy. Sustainability involves several complex interactions and relationships that intersect, such as the planet, and our communities, employees and business practices. We are building on our history of quality in all that we do and are developing a new environmental impact program with metrics and reporting standards.

We engaged third-party consultants for sustainability risk management and are working to quantify the impact of actual farm practices by using evidence-based measurements. This data will provide more depth to decision-making. The project will include Limoneira’s key performance indicators including soil health, nutrient management, resource efficiency, biodiversity, water quality and quantity, energy and carbon.future generations.

Limoneira Company |

|

|

We have an Environmental Policy and are committed to the guiding principles of the policy:Corporate Governance Highlights

•compliance with all applicable environmental regulations;Adoption of updated 2023 Ethics Code;

•trainingAdoption of staff on our environmental programsAmended and empowering themRestated Recoupment of Incentive Compensation Policy (“Clawback Policy”) to contributecomply with Section 10D of the Securities Exchange Act of 1934, as amended, Exchange Act Rule 10D-1, and participate;Nasdaq Stock Market Listing Rule 5608;

•preventionAdoption of pollution whenevera Code of Business Conduct and wherever possible;

•clear communication of environmental commitments and efforts to our supply chain suppliers, staff, customers, investors and the communities in which we operate;

•conservation of natural resources through careful planning and efficient use of water, energy, and materials;

•waste minimization through source reduction, reuse, recycling, and composting;

•handling and disposing of waste through safe and environmentally sustainable methods;

•employing environmentally responsible practices when handling and disposing chemicals and hazardous materials, including wastewater and solid water generated from operations;Ethics for Directors (“Directors Code”); and

•minimizing the generationAdoption of greenhouse gases,Amended Policy Regarding Insider Trading, Tipping and the unintended releaseOther Wrongful Disclosures and Guidelines with Respect to Certain Transactions in Securities of substances that could cause harm to air, water, or land.Limoneira Company and Other Companies in which Limoneira Maintains a Relationship (“Insider Trading Policy”).

•Seven current directors; six are independent and two, or 29%, are women;

To reduce our energy use and related emissions contributing to climate change, we look for ways to decrease our reliance on fossil fuels and increase our use•Standing committee chairs are independent, consisting of renewable energy. Over the past few years, we invested in various renewable energy projects including solar energy.

Our solar program is generating clean energy and savings to our Company. We have implemented Tesla’s 400kWh scalable energy storage system, which reduces energy costs, improves reliability for demand charges and shifts energy use from peak to off peak times. This enables us to generate 50%independent chairs of the energy the Company consumesAudit Committee, Risk Committee, Compensation Committee and we have a goalNominating Committee;

•Executive sessions of being 100% self-powerednon-management directors at each regular Board and committee meetings;

•75% of committee leadership roles are held by 2026.women;

Landfill and Recycling•

Landfill gases have an influence on climate change. The major components of landfill gasses are carbon dioxide and methane, both of which are greenhouse gasses. Methane is over 25 times more detrimental to the atmosphere than carbon dioxide. We recognize that we have an important role to play in reducing greenhouse gas emissions to protect the healthSix of our planet todayseven Board members have experience on other public company boards and for the benefit of future generations. Our 10-acre recycling facility on Limoneira property receives over 200 tons a day of organic green waste that would otherwise be transported to landfills. The end-product produced at this facility helps us, and other growers, to significantly reduce the use of water, herbicides and fertilizers. Our approach not only reduces the environmental impacts of food waste going to landfills and releasing toxins and greenhouse gases, but also helps communities’ access healthy fruits and vegetables.

Limoneira instituted a corporate recycling program in the early 2000’s. The following items are recycled: cardboard, paper, magazines, newspapers, glass containers, plastic bottles and metal containers.

Water

Limoneira is particularly sensitive to water usage, and is committed to reducing the harm caused by water over-usage. To that end, the Company is committed to actively reducing its water use, assessing water risks where it operates, implementing water stewardship in all operations, and working with stakeholders in shared watersheds.

We understand the importance of maintaining the balance between water demand and supply. We consider how water scarcity affects our operations, as well as the impact we have on the water resources we share with the communities in which we operate. Our farms, employees and local communities all depend on safe and clean water to thrive; our growers rely on clean water to produce healthy crops; and our facilities need clean water to prepare our produce for consumption. Limoneira takes important steps to protect this valuable resource. Farming practices at Limoneira leverage innovative technologies to drive water use efficiency and work proactively to prevent potential negative impacts on community water resources.

|

|

|

Water quality and supply is maintained through rigorous lab testing, filtration systems, and a network of micro sprinklers. Water probes are partthree of our innovative water management practices. Soil moisture probes measure volumetric water contentseven Board members are current or former public company CEOs; and are connected to data loggers utilized in the irrigation control system. Soil moisture stations log water data and send it to a main controller. The amount of fertilizer in the water at certain depths is also monitored. Moisture sensors can determine when orchards are at full water holding capacity, thus reducing run off and wasted water. Limoneira’s new natural wastewater system uses patented technology that has a series of gravity fed ponds that circulate and clean 30 million gallons of water annually using natural vegetation, local plants and fine gravels. Ultraviolet rays remove any bacteria in the water to achieve Title 22 of California’s Code of Regulations drinking water standards. This water is then used for landscape irrigation.

Furthermore, Limoneira supports Resolution 64/292 adopted by the United Nations General Assembly explicitly recognizing the human right to water and sanitation. Resolution 64/292 calls upon states and international organizations, like Limoneira, to provide safe, clean, assessable and affordable drinking water and sanitation for all.

Integrated Pest Management•